Services

We build fully automated quantitative investment strategies

for banking institutions, funds, funds of funds, family offices and high net worth individualsAbsolute Return

Return profiles decorrelated from international financial markets

Backtesting

All strategies are backested using historical data over the long run

Risk Management

Our trading platforms are geared to limiting downside risks

Sharpe Ratios

We focus on maximizing risk-adjusted returns rather than returns

Enrich your own discretionary trading with our models

Portfolio Recommendations

Our advisory clients also use our models to enrich their own discretionary trading with our portfolio recommendations

Mathematics, Statistics & AI Applied to Financial Markets

State-of-the-Art Artificial Intelligence, Advanced Statistics & Big DataDiversified Strategies for Capital Preservation

Preservation of capital is a conservative investment strategy where the primary goal is to preserve capital and prevent loss in a portfolio.

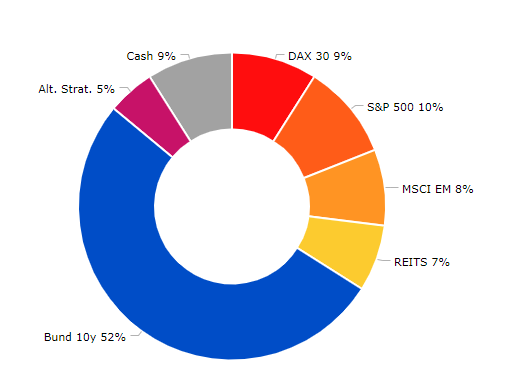

We provide different global macro investment strategies for capital preservation. The basic rules are to invest into a diversified class of assets that are trending up, and to stabilise returns over the long run (by minimizing the historical volatility).

Alternative Strategies for High Returns

Our alternative strategies are geared towards customers seeking high returns.

As such, they should expect such strategies to entail a certain degree of risk. By nature these alternative strategies should only be used as a small addition to existing portfolios.